Image Credit: Canva

The Tennessee Conservative Staff –

Proposed legislation that would exempt disabled veterans from some Tennessee state taxes and fees is scheduled to be heard by the House Departments and Agencies Subcommittee on Tuesday, March 11.

House Bill 0052 (HB0052) is sponsored by State Representative Gino Bulso (R-Brentwood-District 61). The legislation will enact the Veterans Assistance for Livelihood, Opportunity, and Relief Act, also known as the VALOR Act.

The VALOR Act, as written, “exempts disabled veterans who have 100 percent permanent and total disability from a service-connected cause from the payment of certain taxes and fees.”

The bill would allow those individuals to obtain a permanent hunting and fishing license for the state at no cost. Additionally, they would be exempted from paying taxes or fees for the registration of one private vehicle and any local property taxes paid on property owned by the disabled veteran and used as the primary residence will be paid from the state’s general fund.

The changes would go into effect on January 1, 2026, if passed.

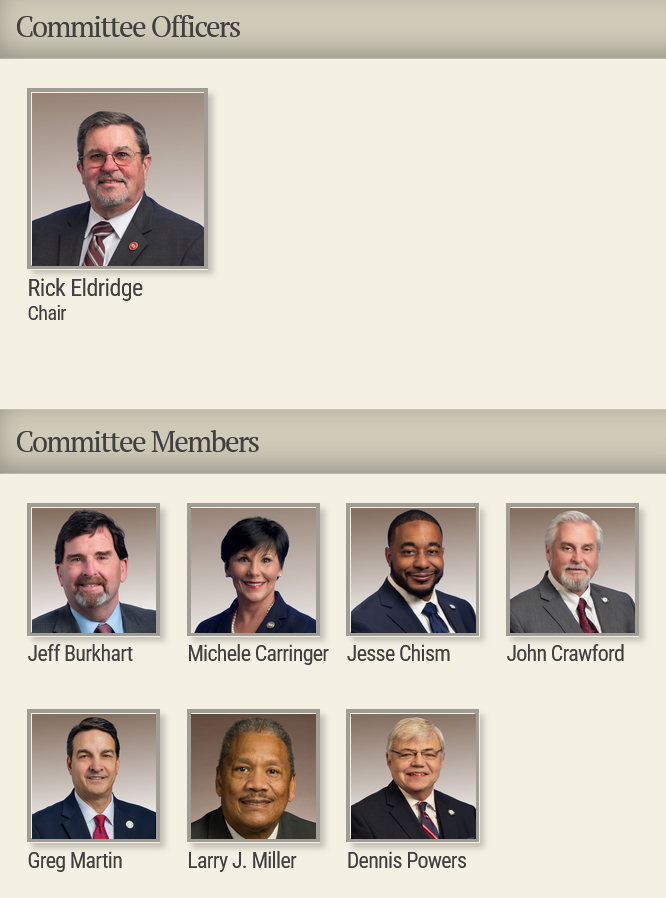

Contact information for the House Departments and Agencies Subcommittee below:

HB0052 Summary: As introduced, enacts the “Veterans Assistance for Livelihood, Opportunity, and Relief (VALOR) Act,” which exempts disabled veterans who have 100 percent permanent and total disability from a service-connected cause from the payment of certain taxes and fees.

Rep.rick.eldridge@capitol.tn.gov, rep.jeff.burkhart@capitol.tn.gov, rep.michele.carringer@capitol.tn.gov, rep.jesse.chism@capitol.tn.gov, rep.john.crawford@capitol.tn.gov, rep.greg.martin@capitol.tn.gov, rep.larry.miller@capitol.tn.gov, rep.dennis.powers@capitol.tn.gov