Image Credit: Canva

The Tennessee Conservative [By David Seal]-

Prior to 2007, county governments got a share of real estate transfer taxes that were collected at the county level when deeds were registered. The local share was taken away during the Bredesen Administration, but legislators hope to return those funds to county governments.

With the dramatic increase in property values and the great need for additional local revenue, many people, including legislators and local officials, are saying the time has come to return at least a portion of the real estate transfer tax to the counties where the taxes are collected.

Montgomery County is one of many local jurisdictions asking the legislature to return 50% of the real estate transfer taxes that are collected by the local register of deeds offices across the state. Each time a real estate transaction is recorded, a fee of $.37/$100 of value is charged and sent to the state coffers, less a small percentage that is kept by the register of deeds to cover administrative costs.

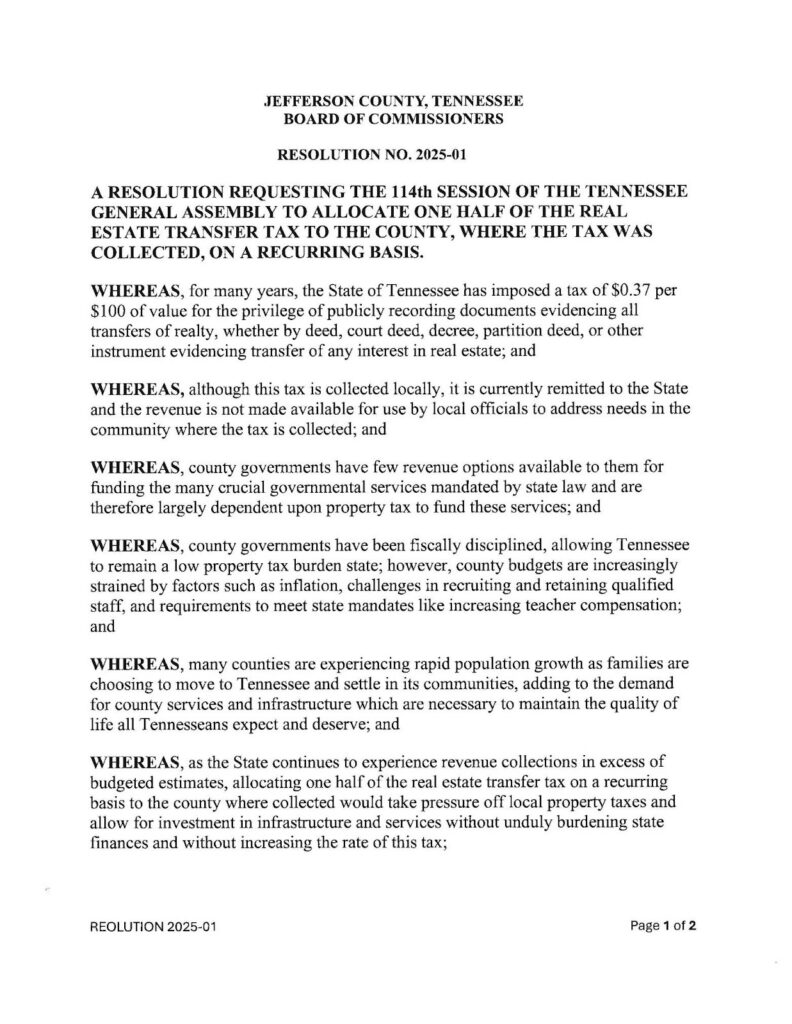

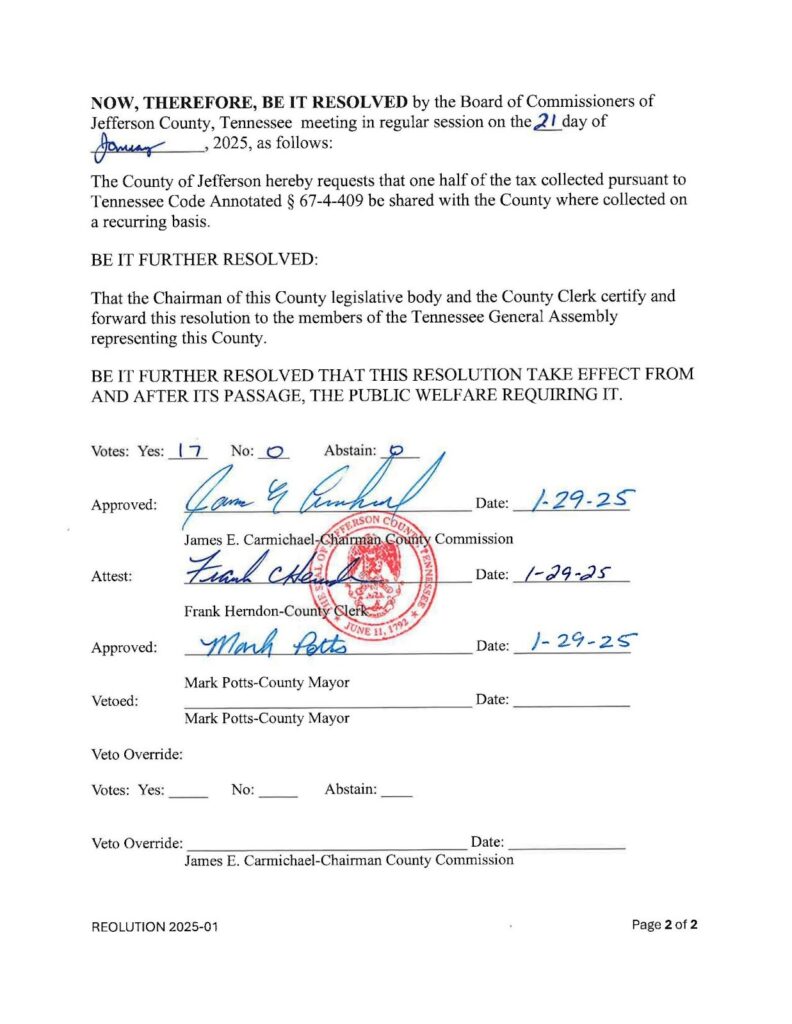

Jefferson County, Tennessee County Commission unanimously passed a resolution in January formally asking the legislature to return 50% of the Real Estate Transfer Tax to the county where it is collected, (Resolution 2025-1). In Jefferson County, the passage of SB1080/HB649 could mean an extra one million dollars per year of revenue that could be used on road repairs, debt service and other specified expenditures.

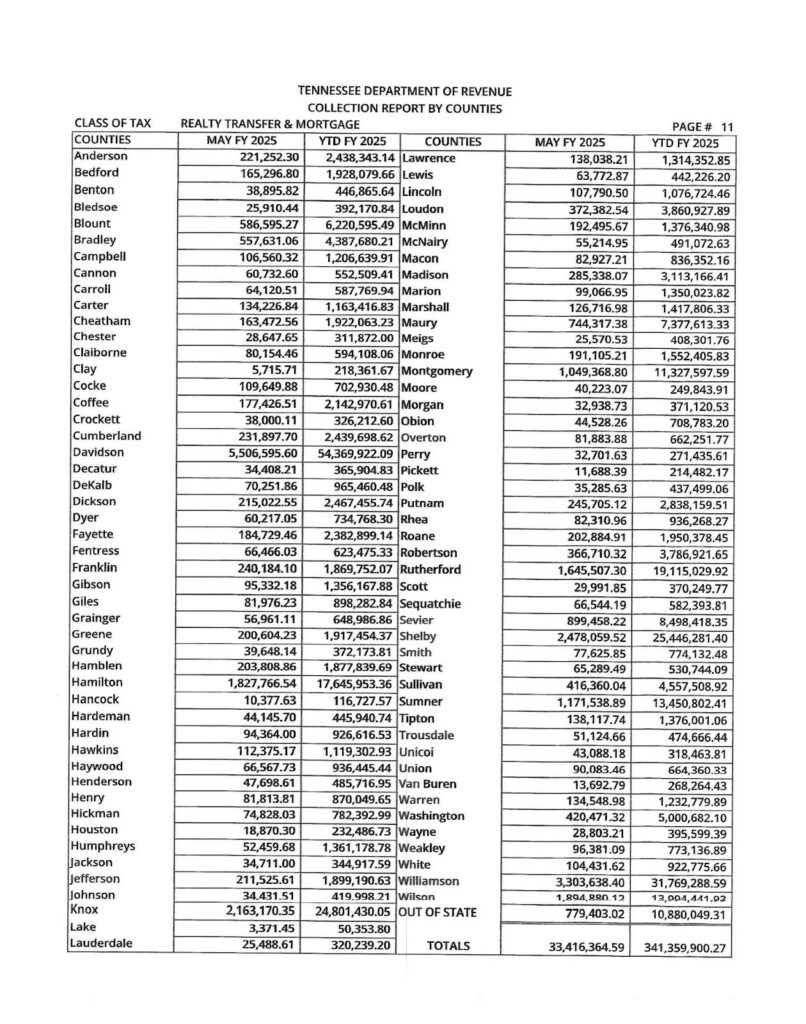

Statewide, the revenue from the Recordation Tax is just over 341 million dollars. To calculate your county’s annual share of the revenue if SB1080/HB649 is enacted, use 50% of the tax revenue shown for each county. The following chart shows the most recent real estate tax (Recordation Tax) for each county in the state for Fiscal YTD 2025.

In reference to Jefferson County Resolution 2025-1, “We appealed to state legislators with our resolution to enact legislation to return 50% of the Real Estate Transfer Tax to the counties where it is collected to help with much-needed local revenue. We encourage other county governments to join the effort by making their own resolutions of the same.” – said Marcus Reed (R-Jefferson City), Tenth District Jefferson County Commissioner

The following is a copy of Jefferson County’s unanimously approved Resolution.

SB1080/HB649 will be the topic of discussion in the upcoming 2026 legislative session. The full text of the bill is linked here.

For a complete financial analysis of the bill, the legislature’s Fiscal Review Note is linked here.

About the Author: David Seal is a retired Jefferson County educator, recognized artist, local businessman, 917 Society Volunteer, and past Chairman of the Jefferson County Republican Party. He has also served Jefferson County as a County Commissioner and is a citizen lobbyist for the people on issues such as eminent domain, property rights, education, and broadband accessibility on the state level. David is also a 2024 winner of The Tennessee Conservative Flame Award & has received an accolade from the Institute For Justice for successfully lobbing the TN legislature to protect property rights. David can be reached at david@tennesseeconservativenews.com.

One Response

Bredesen was no good.