Image Credit: Office of the TN Comptroller

The Center Square [By Jon Styf] –

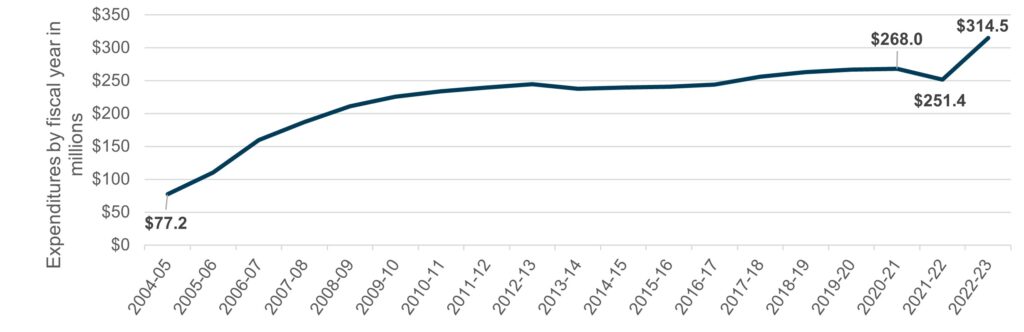

Tennessee spent $314.5 million to assist 70,633 students with HOPE scholarships in the 2022-23 fiscal year, according to a new report from the Tennessee Comptroller’s office.

To get the scholarships, students must have at least a 3.0 grade-point average throughout high school or receive a composite ACT score of 21 or SAT score of 1060.

The scholarships began in 2003 and have increased five times since then with the current value at $4,500 per year for freshman and sophomores at four-year colleges and $5,700 for juniors and seniors. The scholarships are worth $3,200 per year for students at two-year colleges.

In 2019, the Tennessee Legislature began adding sports wagering taxes to the funding of the scholarships and last year the Lottery for Education program received $65.7 million from that tax on sports wagering.

To maintain the scholarship, the student must have at least a 2.75 cumulative GPA at the end of the semester when the student attempted to reach 24 and 48 semester hours and then a 3.0 cumulative GPA at the end of the semester when they attempt to reach 72 hours and every 24 hours attempted after that.

It’s unclear how changes that began in July to the way sports wagering is taxed in the state – moving from taxing sportsbooks’ adjusted gross income to taxing all gross wagers – will impact that funding.

The Comptroller’s Office advised the State Funding Board to ask the Tennessee Sports Wagering Council to provide the group with future tax collection projections in order to plan better for the program.

The HOPE Scholarship cost 73.6% of the $427.1 million in Lottery for Education Account spending last year.

“As a result of this work, I have asked the State Funding Board staff to invite the Sports Wagering Council to our annual revenue estimating meeting,” Comptroller Jason Mumpower said. “With the increasing revenues from sports wagering, it’s important to have a better understanding of how these dollars are impacting the funding available for scholarships.”

After a slight increase in sports wagering taxes from July 2022 to July 2023, Tennessee collected $4.46 million in taxes in August 2023 compared to $4.88 million in August 2022 despite more wagers being placed in August 2023 than a year before.

For the first six months of 2023, the state collected more in taxes under the old system than it would have collected under the new system.

Of the sports gambling taxes, 80% of the taxes collected from sports gambling goes to education, 15% goes to the state for distribution to local governments and 5% goes toward mental health programs.

About the Author: Jon Styf, The Center Square Staff Reporter – Jon Styf is an award-winning editor and reporter who has worked in Illinois, Texas, Wisconsin, Florida and Michigan in local newsrooms over the past 20 years, working for Shaw Media, Hearst and several other companies. Follow Jon on Twitter @JonStyf.