Part Of A New Economic Policy Initiative By Tim Burchett Is The Opportunity Zone Extension Act Of 2021, Which Would Add Two Years To The Current Opportunity Zones Program, Giving More Time For Investment In Communities Impacted By The Coronavirus Pandemic.

Photo: Opportunity Zone Building in Nashville, TN

Photo Credit: CC

Published April 8, 2021

By Makenzie Jones [The Tennessee Conservative contributor] –

The Opportunity Zones program is a bipartisan legislation co-sponsored by Tim Burchett (R-TN) and Henry Cuellar (D-TX) created under the 2017 Tax Cuts and Jobs Act.

Currently, investors are allowed to defer taxes on capital gains that are invested in Opportunity Zones until Dec. 31, 2026.

The existing law states that liabilities can be reduced by 10% if investments are held for five years and an additional 5% if held for seven years, but this is currently beyond the end date of the program. The proposed extension would make the full 15% reduction possible while also providing two more years to invest in communities in need.

On March 31, a roundtable event was held at Historic Kerns Bakery, an Opportunity Zone in South Knoxville for mixed-use development to include restaurants, retail, offices, and hotels.

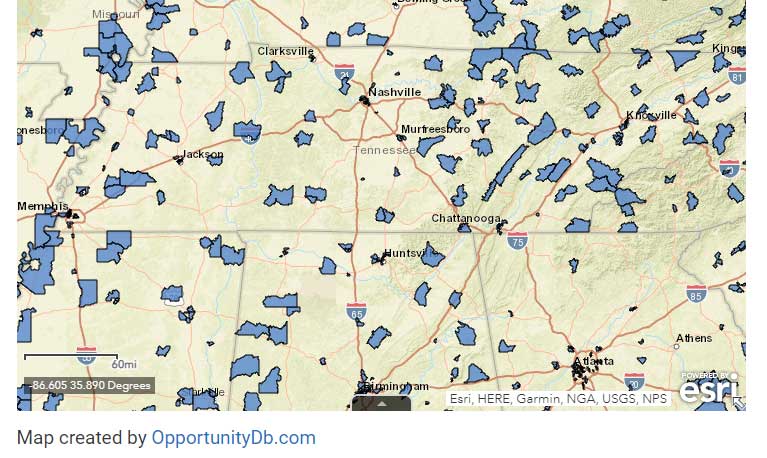

Speaking to the impacts of the program in Tennessee, Burchett says, “Tennessee has 176 Opportunity Zones; 32% are in rural areas and 68% in urban communities.” He also credits the zones for generating $52 billion in new investment and creating half a million jobs in economically distressed communities before the pandemic.

Co-sponsor Cuellar highlights the forward-looking goals of the program and extension in light of COVID-19 impacts, saying, “This critical legislation will help stimulate economic growth, job creation, and provide support to underdeveloped communities. Through this legislation we will be able to help accelerate our economy’s recovery from the pandemic. I am committed to making sure everyone has access to opportunity and can achieve the American dream.”

President Biden has also proposed using the Opportunity Zone incentive as part of his Build Back Better platform, although some reforms would be made, including US Treasury reviews of benefits, required detailed reporting, and public disclosure.

Geographic areas chosen for the zones are from qualifying low-income census tracts based on the 2010 census, so questions have arisen about what changes will come from the 2020 census data. No change will be seen in 43%, 20% will increase in size, 20% will decrease in size, and the remaining will be split into two or more.

Novoco reports that there is a total of 8,764 Opportunity Zones across all 50 states, six territories, DC, and two in Puerto Rico. The Opportunity Zones Database provides a map of OZs across the country.

The overarching economic initiative is focused on access to capital, government efficiency, and criminal justice reform. Burchett himself called the plan a “moonshot” but aims to set priorities at the federal level with the goal to “spur investment and revitalization in under-served and often forgotten areas of urban and rural America.”

A bill called the Microloan Transparency and Accountability Act is to ensure rural small business access to a micro-loan program through the Small Business Administration for easier access to capital and resources regardless of background or location.

A third part of the initiative is the Prison to Proprietorship for the Formerly Incarcerated Act to give nonviolent prisoners business counseling and give convicts a second chance to succeed. He wants to give these people opportunities so that the prison system does not become a “revolving door.”