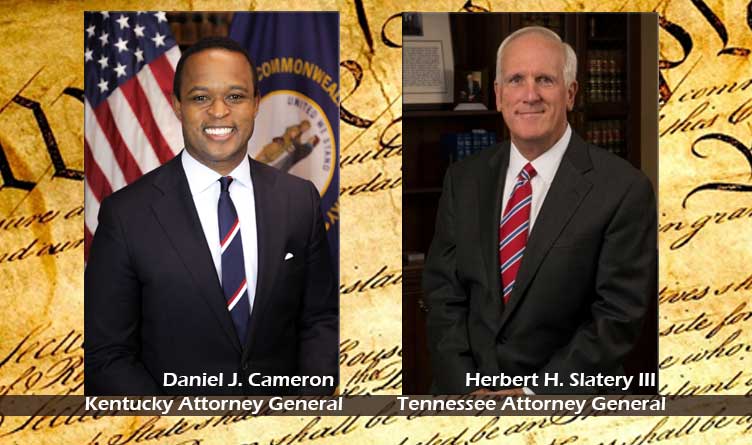

Photo: Kentucky Attorney General Daniel Cameron & Tennessee Attorney General Herbert H. Slatery III

Photo Credit: ag.ky.gov / tn.gov

Published April 8, 2021

The Tennessee Conservative Staff –

Attorneys General from Kentucky and Tennessee have come together to file a lawsuit against the Biden Administration. The lawsuit claims that a tax mandate in the American Rescue Plan is unconstitutional and takes authority over from State legislators.

The Act became law in March and will use $200 billion to provide Covid relief to state governments. As a condition of the relief package, states would not be able to lower taxes on citizens for four years.

Nashville Attorney General Herbert H. Slatery III said, “The states have a constitutional right to implement their own tax policy. We should not have to choose between accepting COVID-19 relief funds or surrendering to Washington’s attempt to override what only our elected officials in Tennessee are authorized to do.”

Kentucky Attorney General Daniel Cameron also spoke out about the motion.

He said, “Kentuckians expect state tax policies to be set by the men and women they elect to represent them in the General Assembly, and not as a result of an edict from the Federal Government. These COVID relief funds are essential to helping the Commonwealth and hardworking Kentuckians recover from the effects of the pandemic, and it is unconstitutional for the Biden Administration to hold the funds hostage if we don’t agree to Washington’s preferred tax policies. I’m proud to join with Attorney General Slatery to push back against federal overreach in its worst form.”

Both attorneys filed the lawsuit against the Biden Administration, calling the Act a “power grab.”

The lawsuit argues that this type of tax mandate “is an unprecedented power grab by the federal government at a time when elected officials should be singularly focused on helping their constituents overcome the devastating effects of the pandemic. It usurps the States’ sovereign authority by coercing them into making the policy choices that a bare majority of Congress prefers, and a strictly partisan majority at that, without regard for the citizens of the States or the leaders they elect.”

The motion says the tax mandate keeps any state accepting aid from lowering its taxes. “Once a state accepts financial aid under the Act- aid that might range from 20 to 40 percent of the State’s total annual revenue- that State is prohibited from setting its own tax policy if doing so will cause a net decrease in tax revenue. Congress, in other words, is using the carrot of enormous financial aid to outright prohibit States from lowering taxes on their own residents.”

Tennessee itself will be receiving one-fifth of its annual revenue, which is around $3.7 billion.

A group of Attorneys General sent a letter to Treasury Secretary Janet Yellen, asking for more clarification on the tax mandate and what it could mean for states. However, Yellen’s response was not as clarifying as they had hoped for.

This led Attorneys General Cameron and Slatery to claim, “the broad and ambiguous scope of the Tax Mandate has the likely and foreseeable effect of chilling almost any legislative action by the States that affect tax revenue.”