Image Credit: capitol.tn.gov

The Tennessee Conservative [By Jason Vaughn] –

ALEC Action, advocacy partner of the American Legislative Council, has sent a letter to Tennessee Governor Bill Lee strongly urging him to veto legislation that, once made law, could trigger nonprofits to disclose the names of their donors.

ALEC Action’s CEO, Lisa Nelson, said, “If enacted, this legislation would implement an extremely broad, unclear, and dangerous state registry dragnet targeting non-profit organizations, many of which are currently engaged in standard issue advocacy.”

Buried deep within a larger ‘campaign finance reporting bill’ is the section that concerns ALEC Action as it applies to 501(c) 4 non-profits, like themselves.

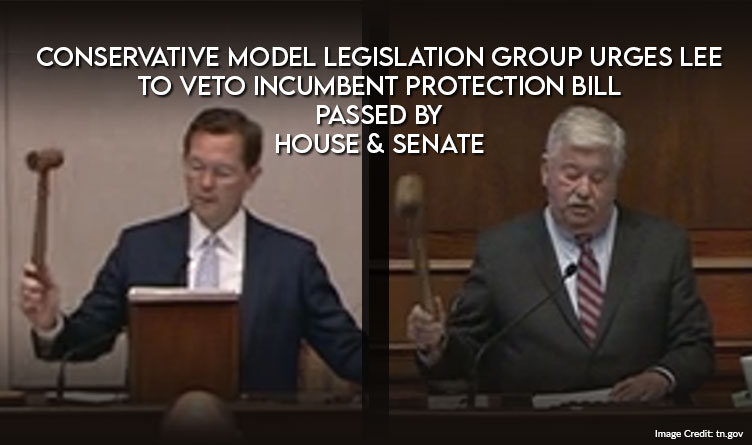

House Bill 1201, sponsored by House Speaker Cameron Sexton (R-Crossville-District 25 ) and Senate Bill 1005, sponsored by Lt. Governor Randy McNally (R-Oak Ridge-District 5), sets forth a number of campaign finance guidelines. The concerning portion of the bill would require nonprofit 501( c) (4), 501 ( c) (5), and 501 ( c) (6) organizations to report any expenses in excess of $5,000 within sixty days of an election if the candidate’s name or image is included.

The most recent amendment to the legislation that ‘made the bill’ was voted on and passed by both the House and Senate. The final amendment came about as a result of a disagreement between the two chambers on previous amendments’ content. A committee revised portions of the amendment and the chambers voted in favor. The amended section that applies to non-profits reads as follows:

Section 13:

Notwithstanding another law to the contrary, an organization that is tax exempt under United States Internal Revenue Service Code § 501(c)(4), (5), or (6) (26 U.S.C. § 501(c)(4), (5), or (6)) is required to report expenditures in accordance with § 2-10-105(c)(1) and (h) during the remainder of an election year and certify the name and address of any person who directly controls such expenditures along with any such person’s evidence of identification as defined in § 2-10-105(e)(3)(C) to the registry of election finance if:

(A) The organization expends an aggregate total of at least five thousand dollars ($5,000) in organizational funds, moneys, or credits for communications that expressly contain the name or visually depict the likeness of a state candidate in a primary or general election; and

(B) Such expenditures or communications occur within sixty (60) calendar days immediately preceding a primary or general election in which the named or visually depicted candidate appears on the ballot.

(2) This subsection (b) does not require an organization that is tax exempt under United States Internal Revenue Service Code § 501(c)(4), (5), or (6) (26 U.S.C. § 501(c)(4), (5), or (6)) to report any form of contributions.

(3) As used in this subsection (b), “communications” does not include:

(A) Any communication by any membership organization solely to its members, employees, or to any person who has expressly consented to receiving communications from the organization;

(B) Any communication made prior to the period described in subdivision (b)(1)(B) but that remains accessible during the period; provided, that such communication is not actively promoted or distributed by the organization within the period to the public at large excluding any person described in subdivision (b)(3)(A); or

(C) Any communication made to an official in the legislative branch or an official in the executive branch during any session of the general assembly.

*** Click Here to Support Conservative Journalism in Tennessee. We can’t cover stories like this without your support!***

ALEC Action voices concerns in their letter that the legislation could result in nonprofits identifying their donors.

This concern is shared by other groups such as Americans for Prosperity and the National Rifle Association.

Tori Venable of Americans for Prosperity stated that the reference above to TCA 2-10-105(c)(1) and (h) could lead to confusion and/or trigger donor disclosure of non-profits.

“They could have removed (h) or added the specific part of the code that referred to the timing of filings. They simply chose not to,” Venable said.

The National Rifle Association agreed that Tennessee Code referenced in the legislation (TCA 2-10-105(c)(1) and (h) ) could create confusion and trigger donor disclosure as that portion of the current law requires donors to be included in reporting.

Sponsors and Cosponsors of the bill argue that the portion of Tennessee Code referred to above was included solely to designate the timing of the reporting and that nonprofits are not required to disclose their donors. However, the legislation itself does not make that clear.

The ALEC Action letter to Governor Lee, acquired by TNJ: On the Hill, reads as follows:

Dear Governor Lee,

ALEC Action writes with strong concerns regarding S.B. 1005/H.B. 1201. Given the extremely ambiguous language, low thresholds for expenditure reporting, and what would likely be unconstitutional requirements of compelled donor identity disclosure, we strongly encourage you to veto this legislation.

This bill requires organizations designated as tax-exempt by federal law, including 501(c)(4)s, (5)s and (6)s, to report their expenditures to the Tennessee Registry of Election Finance after certain communication and financial thresholds are met. This non-profit reporting requirement is triggered after a financial threshold in the aggregate amount of only $5,000 is met and when spent towards certain communications 60 days before an election, however, this legislation fails to provide a clear definition of qualifying communications. If enacted, this legislation would implement an extremely broad, unclear, and dangerous state registry dragnet targeting non-profit organizations, many of which are currently engaged in standard issue advocacy. Further, it is unclear how Tennessee agencies and courts will interpret this law, creating a variety of issues for them, the tens of thousands of organizations spread across the political spectrum in Tennessee, and the donors who support them.

The right of philanthropists to keep their giving private is a longstanding constitutional protection that should be respected by states. It is for this reason that ALEC filed an amicus brief in support of a case where the United States Supreme Court upheld these very principles and privacy protections. Further, the proposals in S.B. 1005/H.B. 1201 are inconsistent with ALEC Action principles, such as the Statement of Principles on Philanthropic Freedom as well as the Resolution in Support of Nonprofit Donor Privacy. Referring to a candidate’s position on policy matters should never result in the disclosure of donor information from non-political groups, and legislation should not seek to classify such organizations as entities required to do so. Policy that seeks to address campaign finance issues simply by expanding legal thresholds and reporting requirement windows does not truly address election integrity matters, but instead burdens numerous organizations with onerous reporting requirements, while violating the privacy rights organizations and their supporters are entitled to.

S.B. 1005/H.B. 1201 is a drastic overreach that would encroach on the privacy rights of non-profit organizations and their donors, all while creating a chilling effect on free speech. Because of the consequences of such a proposal, along with its inconsistencies with limited government principles, ALEC Action encourages you to veto S.B. 1005/H.B. 1201.

Sincerely,

Lisa B. Nelson

Chief Executive Officer

ALEC Action

The legislation, touted by sponsors to be “all about transparency,” started its life as an obscure, generically-worded caption bill back in February 2021, but was altered in April 2022 with a 15-page amendment that made the bill.

The legislation has now undergone several additional amendments/changes and has been passed by the House and Senate. It is now enrolled and ready for the signatures of House Speaker Cameron Sexton and Lt. Gov. Randy McNally. Once the speakers of the chambers sign off on the bill, it will be transmitted to Governor Lee to be signed into law, vetoed, or allowed to become law without his signature.

In his time in office, Lee has never vetoed a bill, but he has allowed several to become law without his signature including recent legislation concerning truth in sentencing, regulation of homeless encampments and recognition of acquired immunity to COVID-19.

About the Author: Jason Vaughn, Media Coordinator for The Tennessee Conservative ~ Jason previously worked for a legacy publishing company based in Crossville, TN in a variety of roles through his career. Most recently, he served as Deputy Director for their flagship publication. Prior, he was a freelance journalist writing articles that appeared in the Herald Citizen, the Crossville Chronicle and The Oracle among others. He graduated from Tennessee Technological University with a Bachelor’s in English-Journalism, with minors in Broadcast Journalism and History. Contact Jason at news@TennesseeConservativeNews.com

4 Responses

What are these legislators COMMUNIST OR SOMETHING????? since when do they need protection so they can stay in office and no one can run against them. If that is the case then they all need to go after 1TERM!!!!l Time for Tennessee to set up TERM LIMITS ON THIS.

That in my opinion, is the number one thing we could do to clear out the corruption.

Regarding Incumbent Protection Bill. Anything that I read 3 times and it still seems vague can’t be in favor of liberty.

How about a law that only allows contributions from INDIVIDUALS who are eligible to vote for the person to whom they are contributing? So you can only contribute to those who will represent you. NO corporate donations, NO charitable organization donations, NO PAC donation, NO “Special Interests” period, only individuals from the representative district.