Image Credit: Jefferson County Government & Canva

The Tennessee Conservative [By David Seal] –

Proposed legislation in the upcoming Tennessee General Assembly Legislative Session could return more than one hundred and forty-one million dollars (141,000,000) of revenue to local governments.

All Tennesseans have a financial interest in getting this legislation passed.

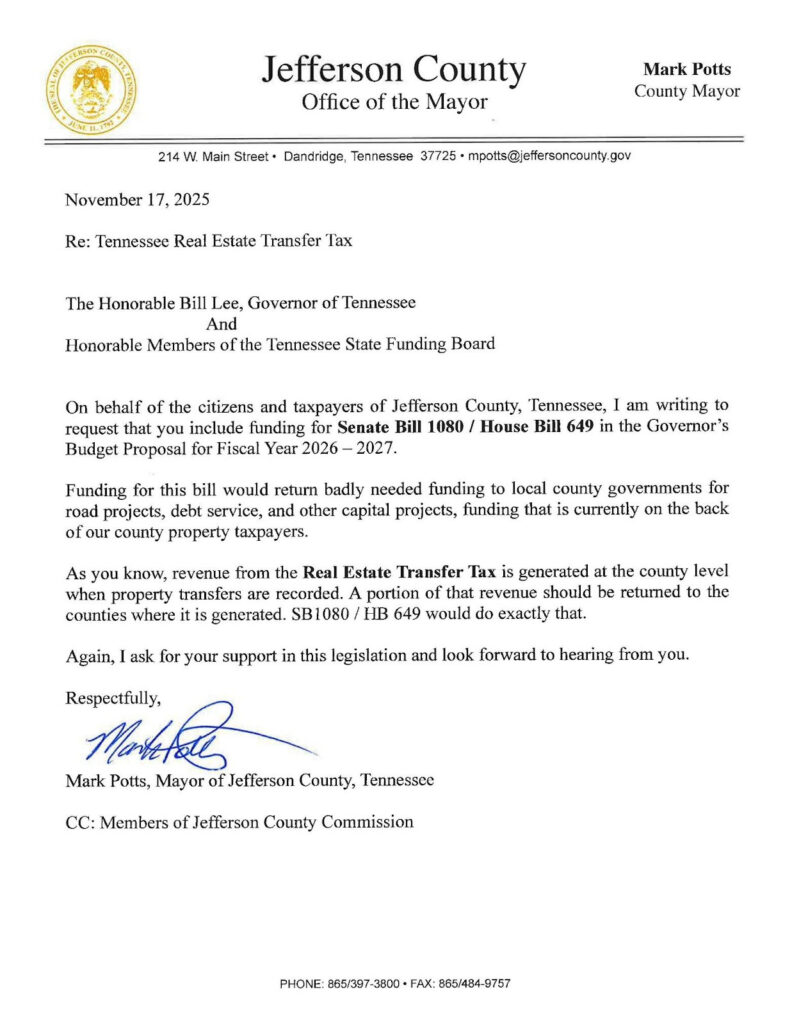

Jefferson County Mayor Mark Potts (R-Dandridge) is taking the lead in getting other county mayors in Tennessee to get on the bandwagon to support the legislation. He sent a letter to the Governor of Tennessee and the State Funding Board requesting that funding for the legislation be included in the Governor’s Budget Proposal.

“I urge my fellow county mayors across Tennessee to contact the governor and state funding board and ask that appropriations for Senate Bill 1080 and House Bill 649 be included in the governor’s 2026-2027 Fiscal Year Budget Proposal. Getting a portion of the Real Estate Transfer Tax revenue back to the counties where it is generated would help enormously with road repairs and capital improvements.” said Mark Potts, Mayor of Jefferson County

A copy of Potts’ letter is provided as a template at the end of this article.

Senator Jack Johnson (R-Franklin) is proposing SB 1080. Representative Pat Marsh is sponsoring HB 649 as a companion bill in the House Chamber. The bills would return 50% of the proceeds of the Real Estate Transfer Tax to county governments for road repairs, debt service, capital improvements, and other non-reoccurring expenses.

In Jefferson County, Tennessee, the success of the legislation could mean an additional $940,000.00 in additional revenue to the county coffers.

According to the bill’s senate sponsor, prior to 2007, fifty percent of the proceeds from the tax were provided to county governments where the tax is collected when real estate is transferred. In the Senate State and Local Government Committee, Johnson said the bill would bring those funds back to the local county governments where they belong.

To see a video clip of Johnson explaining how the revenue was taken from county governments during the Bredesen Administration, a link is provided here.

A Jefferson County Commissioner also expressed his support for SB 1080 / HB 649 as follows.

“We respectfully ask Tennessee Governor Bill Lee and Honorable members of the Tennessee State Funding Board to please fund Senate Bill 1080 / House Bill 649 in the Governor’s Budget for Fiscal Year 2026-2027. Monies that are generated from the Real Estate Transfer Tax in Jefferson County would truly ease the burdens on taxpayers of the county and help with much needed financial support for progress countywide.” -said Ronny Coleman (R-Chestnut Hill), Commissioner, 8th District, Jefferson County, Tennessee

A copy of Mayor Potts’ letter to the Governor and State Funding Board is as follows.

About the Author: David Seal is a retired Jefferson County educator, recognized artist, local businessman, 917 Society Volunteer, and past Chairman of the Jefferson County Republican Party. He has also served Jefferson County as a County Commissioner and is a citizen lobbyist for the people on issues such as eminent domain, property rights, education, and broadband accessibility on the state level. David is also a 2024 winner of The Tennessee Conservative Flame Award & has received an accolade from the Institute For Justice for successfully lobbing the TN legislature to protect property rights. David can be reached at david@tennesseeconservativenews.com.

One Response

Good!