Image Credit: TN General Assembly

The Tennessee Conservative Staff –

The House Finance, Ways, and Means Subcommittee passed a joint resolution on Wednesday, urging Congress to enact The Fair Tax Act of 2023.

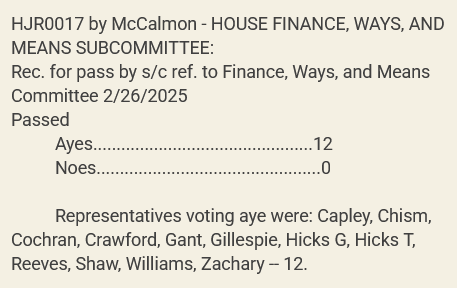

House Joint Resolution 0017 (HJR0017) was introduced by State Representative Jake McCalmon (R-Franklin-D63). The resolution was passed unanimously by the House Subcommittee, with all 12 members voting in favor of the bill.

The resolution is intended to push the United States Congress “to repeal all taxes on income and enact a national retail sales tax as specified in H.R. 25, the Fair Tax Act of 2023.”

HJR0017 acknowledges that the current income tax system:

- Penalizes marriage instead of rewarding it.

- Harms economic growth.

- Has reduced the standard of living for the general public.

- Impedes the international competitiveness of the U.S. industry.

- Reduces savings and investments in this country by taxing income multiple times.

- Slows the capital formation necessary for real wages to steadily increase.

- Lowers productivity.

- Imposes unacceptable and unnecessary administrative and compliance costs on individual and business taxpayers.

- Is unfair and inequitable.

- Unnecessarily intrudes upon the privacy and civil rights of United States citizens.

- Hides the true costs of government by embedding taxes in the costs of everything that Americans buy.

- Is not being complied with at satisfactory levels and “therefore, raises the tax burden on law-abiding citizens” and “impedes upward social mobility.”

Additionally, the resolution denounces federal payroll taxes, including social security, Medicare payroll taxes, and self-employment taxes. It also touts the potential positive impact to be found in a broad-based national sales tax.

The resolution has been placed on the Finance, Ways, and Means Committee calendar for March 4.

Contact information for Committee members can be found below:

Rep.gary.hicks@capitol.tn.gov, rep.john.gillespie@capitol.tn.gov, rep.charlie.baum@capitol.tn.gov, rep.clark.boyd@capitol.tn.gov, rep.karen.camper@capitol.tn.gov, rep.kip.capley@capitol.tn.gov, rep.jesse.chism@capitol.tn.gov, rep.mark.cochran@capitol.tn.gov, rep.john.crawford@capitol.tn.gov, rep.jeremy.faison@capitol.tn.gov, rep.bob.freeman@capitol.tn.gov, rep.ron.gant@capitol.tn.gov, rep.johnny.garrett@capitol.tn.gov, rep.rusty.grills@capitol.tn.gov, rep.michael.hale@capitol.tn.gov, rep.david.hawk@capitol.tn.gov, rep.tim.hicks@capitol.tn.gov, rep.bud.hulsey@capitol.tn.gov, rep.william.lamberth@capitol.tn.gov, rep.harold.love@capitol.tn.gov, rep.larry.miller@capitol.tn.gov, rep.debra.moody@capitol.tn.gov, rep.antonio.parkinson@capitol.tn.gov, rep.lee.reeves@capitol.tn.gov, rep.johnny.shaw@capitol.tn.gov, rep.mike.sparks@capitol.tn.gov, rep.kevin.vaughan@capitol.tn.gov, rep.ryan.williams@capitol.tn.gov, rep.jason.zachary@capitol.tn.gov