Second in a Series of Reports

Image Credit: tn.gov & Canva

The Tennessee Conservative [By David Seal] –

State Representative Elaine Davis (R-Knoxville, District 18) is taking a stand to bring proceeds from the Real Estate Transfer Tax back to the counties where the revenue is generated when real estate transactions are recorded.

In Knox County, passage of Senate Bill 1080 / House Bill 649 would mean an extra 12 million dollars of revenue per year for the county government to use on road repairs, capital improvements, and other one-time expenditures.

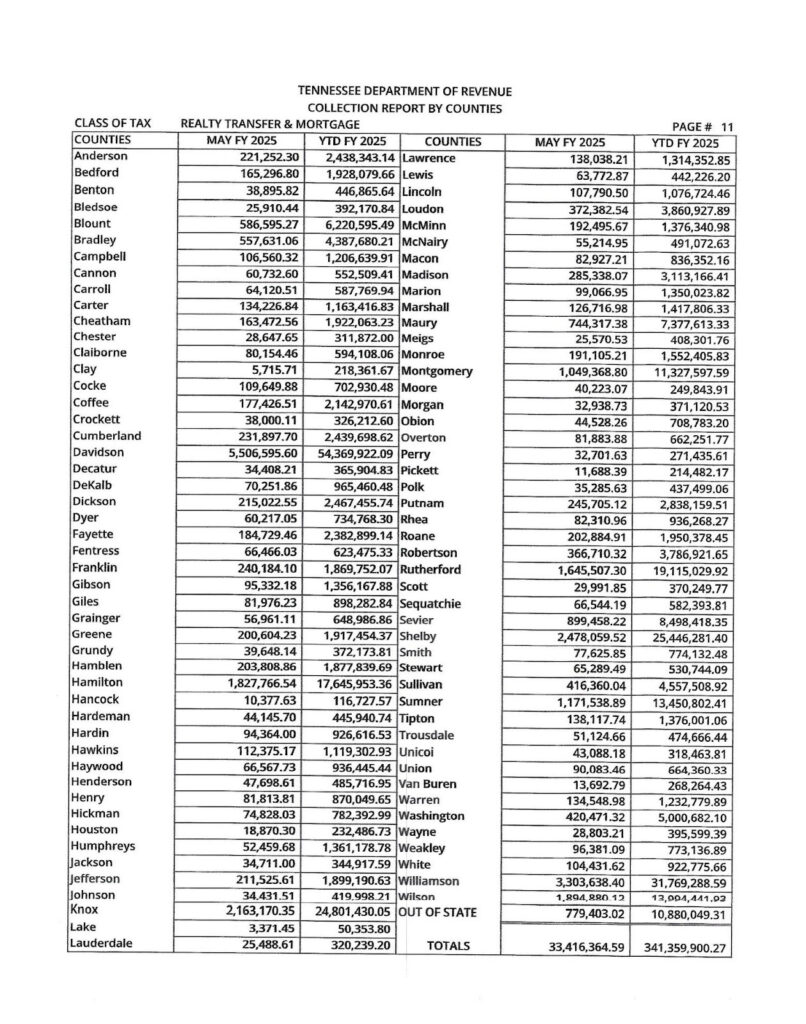

Knox County, like other counties in Tennessee, generates revenue for state coffers when real estate sales are recorded at the Register of Deeds Office. At the current level of transfer, Knox County generates over 24 million dollars per year.

Returning part of this state mandated tax would be a shot in the arm for counties across Tennessee that desperately need funds for roads and capital projects.

SB 1080 / HB 649, if enacted would return 50% of the Real Estate Transfer Tax revenue to local county governments. As the legislative sponsor, Senator Jack Johnson stated in committee, “a portion of the money would be returned to local governments where it belongs.”

County mayors are also pressing for passage and funding for the bill as well. In Jefferson County, Mayor Mark Potts has taken a leadership role in persuading the governor and state funding board to include funding for the bill in the Administration Budget Proposal for Fiscal Year 2026-2027.

For background information, a link is provided here.

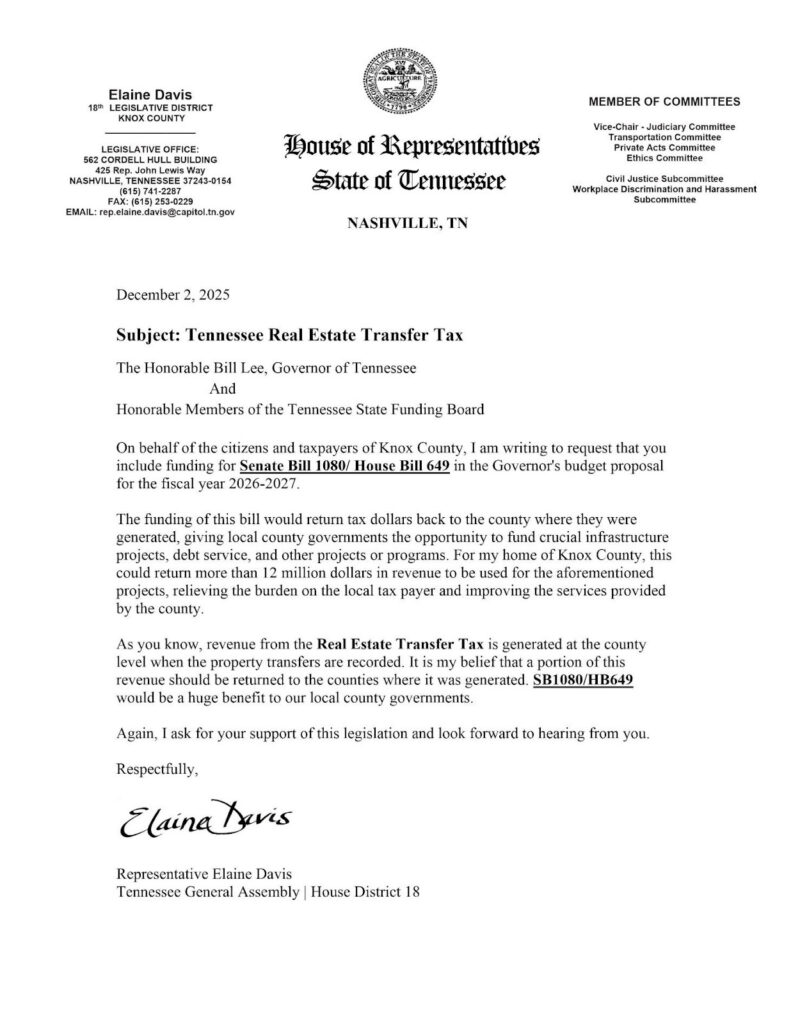

Representative Davis is taking her own leadership role in urging Governor Lee and members of the State Funding Board to provide funding for the bill.

The following chart shows the amount of revenue generated by the Real Estate Transfer Tax county-by-county in Tennessee. SB 1080 / HB 649 would return 50% to each county.

In an interview for this news report, Davis encouraged other legislators to urge the Governor and State Funding Board to include funding for this important legislation in the upcoming administration budget proposal.

Her letter to Governor Lee states in part “The funding of this bill would return tax dollars back to the county where they were generated, giving local county governments the opportunity to fund crucial infrastructure projects, debt service, and other projects or programs.” – said Representative Elaine Davis

The full text of the letter is pictured below.

The Tennessee Conservative News will follow this issue and report as information becomes available.

About the Author: David Seal is a retired Jefferson County educator, recognized artist, local businessman, 917 Society Volunteer, and past Chairman of the Jefferson County Republican Party. He has also served Jefferson County as a County Commissioner and is a citizen lobbyist for the people on issues such as eminent domain, property rights, education, and broadband accessibility on the state level. David is also a 2024 winner of The Tennessee Conservative Flame Award & has received an accolade from the Institute For Justice for successfully lobbing the TN legislature to protect property rights. David can be reached at david@tennesseeconservativenews.com.

2 Responses

This is a GREAT idea.

Thank you David Seal for writing this article.

AMEN!!