Image Credit: capitol.tn.gov

The Tennessee Conservative Staff –

New records indicate that the $1.5 Billion franchise tax change being finalized during the General Session was initiated by requests from 24 businesses, and, if approved, most of that money would not even stay in Tennessee.

This legislative session, Governor Bill Lee has pushed to make a change to the way franchise taxes are calculated for businesses. His proposal would also give $1.5 billion in refunds to businesses based on taxes paid over the last three years.

100,000 businesses would receive refunds, with 81% of those eligible businesses located in the state. However, more than half of the refunded money would be going to locations outside of Tennessee.

The largest portion of the money, nearly a third of those businesses, are in real estate. Another third are in manufacturing and retail.

The House and the Senate have yet to reach an agreement on the specifics of the legislation.

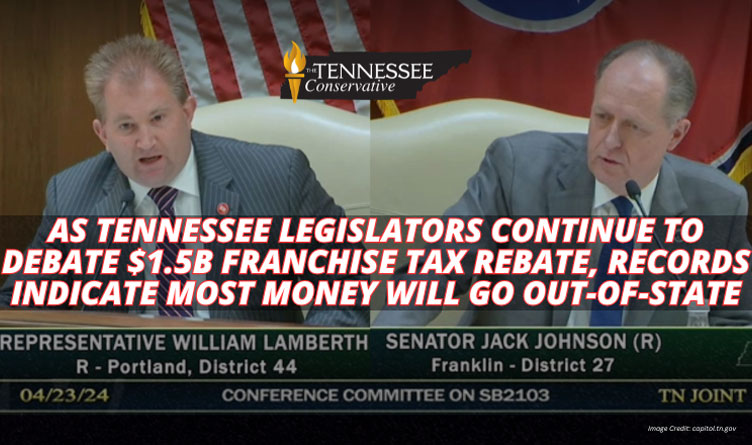

House Bill 1893 (HB1893) is sponsored by Rep. William Lamberth (R-Portland-District 44), and Senate Bill 2103 (SB2103) is sponsored by Senator Jack Johnson (R-Franklin-District 27).

House members want to see the names of those businesses and the amount of their refunds released to the public. They also want to limit the refunds to one year’s worth.

Lee stated as recently as Monday that he was against the release of that information. Critics have noted that it is not clear just how much money would go to Lee’s family business, the Lee Company.

According to the Tennessee Department of Revenue, publicly disclosing information about the companies would be a violation of state laws regarding taxpayer confidentiality.

Despite those confidentiality laws, the Department sent fact sheets to legislators with that exact information, a mere ten days after refusing to provide that information to a reporter, according to an email from the Governor’s Chief Counsel Erin Merrick.

When The Tennessean asked about this discrepancy, Revenue spokesperson Kelly Cortesi stated, “The Department of Revenue routinely prepares informational sheets for legislation for meetings with legislators, and we do not consider them to be private materials.”

Cortesi continued, “The Department of Revenue has not misrepresented any information. The department has consistently stated that approximately 100,000 taxpayers would be eligible for the remedy under the proposed legislation. This is only a portion of all franchise taxpayers.”

Speaker of the House Cameron Sexton (R-Crossville-District 25) previously stated that the transparency clause is “non-negotiable” for House lawmakers.

2 Responses

While some taxpayers that would receive refunds may be headquartered or commercially domiciled outside Tennessee, 100% of the refunds would go to Tennessee business locations. The tax basis at issue is the value of property in Tennessee. Everyone that would be eligible for a refund has a business in Tennessee.

Lucas, I agree with your comment.