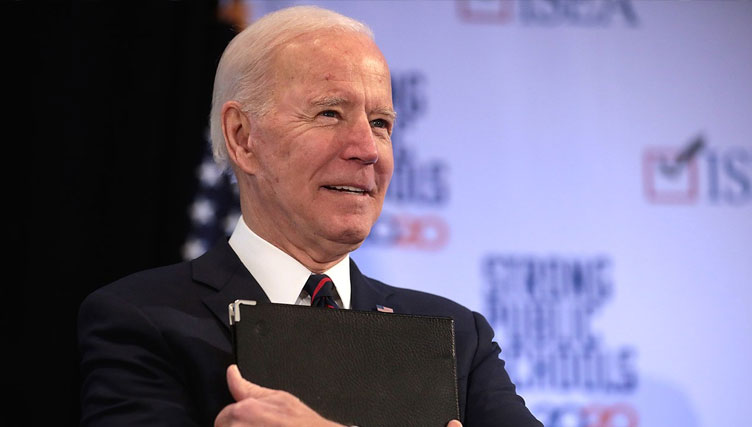

Photo Credit: Gage Skidmore / CC

The Center Square [By Casey Harper] –

President Joe Biden has repeatedly touted that his “Build Back Better” spending bill would not add to the national debt, but the nonpartisan Congressional Budget Office analysis released Friday countered that claim.

Republicans requested the CBO examination before voting on the bill, asking what the cost would be if spending provisions in the bill are continued for 10 years, instead of expiring sooner.

Critics say the bill’s supporters put early expiration dates on new entitlement spending to keep cost projections low, all while planning to re-up those spending measures when they are about to expire.

“I very much appreciate CBO scoring Build Back Better without budget gimmicks,” said Sen. Lindsey Graham, R-S.C., ranking member on the Senate Budget Committee who requested the CBO score. “We all know that the new provisions will not sunset – they never do.”

A previous CBO analysis gave a much lower cost for the plan because many provisions of the bill are set to expire, though Republicans argue those provisions will be given extensions when the time comes, increasing the true cost of the bill.

“The largest difference between the two estimates stems from an increase in the child tax credit that ends after 2022 in the House-passed version of the bill,” CBO said, referring to Biden’s monthly payment to families for each child they have, regardless of whether they are working or pay income taxes.

CBO said the bill “would increase the deficit by $3.0 trillion over the 2022–2031 period” if the provisions do not expire.

The Committee for a Responsible Federal Budget has been a leading group pointing out how the “arbitrary” setting of end dates for programs makes the bill appear less expensive, which the CRFB has called an accounting “gimmick.”

***Click HERE to support Conservative Journalism in Tennessee. We can’t bring you articles like this without your support!***

“The House-passed Build Back Better Act incorporates numerous arbitrary sunsets in order to hold down its costs. Today, the Congressional Budget Office (CBO) released an estimate of the cost of the House-passed Build Back Better Act if most temporary provisions in the bill were made permanent,” CRFB said in a statement. “CBO estimates that if all of these provisions were made permanent without offsets, the plan would add almost $2.75 trillion to the deficit before interest, compared to the $158 billion deficit impact of the legislation as written.”

Republicans blasted the plan after CBO released its projections, pointing to the rising debt and the correlated inflation. Federal inflation data released Friday showed the fastest increase in nearly 40 years.

“Inflation is the enemy of working people in America,” Graham said. “‘Build Back Better’ aids and abets the enemy of inflation, will drive that number up higher.”

Defenders of the bill argued it was unfair to judge the bill based on what the cost would be if the expirations are extended. Biden has indicated he plans to extend the measures but will also find a way to pay for them.

“Here is what those critics are not telling you,” Biden said during remarks at Dakota County Technical College in Rosemount, Minnesota in late November. “They’re not telling you that I’ve committed to paying for every single program that extended, if any are, in future legislation, whether that’s for a day or a decade.”

Critics argue, though, that creating federal spending programs set up “benefit cliffs” that could leave Americans in the lurch.

“Today’s analysis highlights the large cost of permanently extending expiring policies in the Build Back Better Act,” said Maya MacGuineas, president of CRFB. “Arbitrary expirations don’t make policies cheaper, they just make them shorter – and sooner or later politicians will have to come to terms with how to address these new benefit cliffs.”

About the Author: Casey Harper, The Center Square D.C. Bureau Reporter – charper@centersquare.com ~ Harper is a Senior Reporter for the Washington, D.C. Bureau. He previously worked for The Daily Caller, The Hill, and Sinclair Broadcast Group. A graduate of Hillsdale College, Casey’s work has also appeared in Fox News, Fox Business, and USA Today.