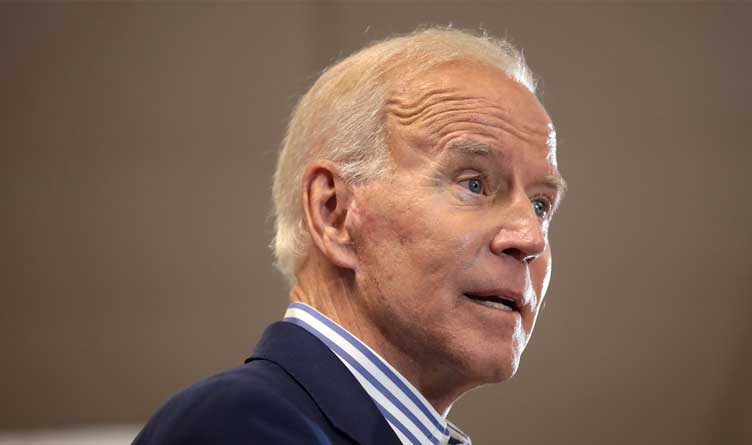

Photo Credit: Gage Skidmore / CC

Published April 8, 2021

The Center Square [By Casey Harper] –

The Department of Treasury released more details Wednesday of a planned tax hike to fund President Joe Biden’s sweeping infrastructure bill.

The Biden administration’s 19-page “Made in America Tax Plan,” focuses on raising taxes on corporations and preventing them from moving profits overseas. The plan claims to raise $2.5 trillion over 15 years.

The tax hike has raised concerns from economists, Republicans and some Democrats. U.S. Sen. Joe Manchin, D-W.V., one of the more moderate Democrats in the Senate and a key vote for Democratic leadership, has voiced opposition to Biden’s current plan.

Manchin pushed back against Biden’s plan to raise the corporate tax rate from 21 percent to 28 percent, arguing it is too high to get his support.

“If I don’t vote to get on it, it is not going anywhere,” Manchin told WVMetroNews radio’s “Talkline” earlier this week. “It’s more than just me. There are six or seven other Democrats that feel strongly about this. We have to be competitive, and we are not going to throw caution to the wind. This whole thing has got to change.”

Critics also argue the tax increases will be passed on to American consumers and lead to fewer jobs.

“When you increase taxes to pay for an increase in federal spending, the result is that you reduce growth and reduce economic activity in the future,” said David Ditch, an economic expert at the Heritage Foundation.

In response to the anticipated backlash over the tax increase – which would be the largest tax increase in decades – Biden promoted the plan in a speech from Washington, D.C. Wednesday afternoon by highlighting how the additional tax dollars would be spent.

First on that list is Biden’s recently unveiled infrastructure bill, the “American Jobs Plan,” which is estimated to cost $2.3 trillion.

In the speech, Biden painted a grim picture of an America left behind by quickly advancing foreign powers, namely China, which he argues will surpass the U.S. in technology and research unless Congress is quick to pass his infrastructure bill.

Biden went off-script before delivering his strongest comments:

“America is no longer the leader of the world because we are not investing,” Biden said from the Eisenhower Executive Office Building, adjacent to the White House. “China and the rest of the world is racing ahead of us. When we were investing in it, we were the leader in the world. I don’t know why we don’t get this.”

How to pay for it:

The new infrastructure bill is just a fraction of the spending Biden pledged while on the campaign trail. To pay for the first of his ambitious spending promises, the tax plan released Wednesday would enact a series of complex measures targeting corporations.

Notably, it would increase funding for the IRS to audit corporations more aggressively and enact “a 15% minimum tax on book income of large companies that report high profits, but have little taxable income.”

The plan also proposes pressuring foreign nations to keep corporate tax rates high so corporations cannot move their operations to countries with more competitive rates.

“The President’s plan provides a strong incentive for nations to join a global agreement that implements minimum tax rules worldwide through the denial of U.S. deductions on related party payments to foreign corporations residing in a regime that has not implemented a strong minimum tax,” the plan reads. “This aspect of the plan is designed to help level the playing field between foreign and U.S. companies.”

Biden could release additional tax increases not included in the plan released Wednesday, some media outlets reported, but so far that is not official.

“There are tax breaks I find difficult to explain,” Biden said in Wednesday’s speech. “Wealthy deductions, $360 billion, a top rate of 39 percent, almost a quarter of a trillion dollars. Corporate minimum tax and the fossil fuel giveaways, $40 billion, et cetera. I could go on.”

Getting through Congress:

Biden’s speech was as wide ranging as the list of spending items in his bill, from expanding internet for rural areas to quantum computing to revamping Veterans Affairs’ hospitals.

The president began his remarks by extending a hand across the aisle, offering to make compromises with Republicans and promising that “changes are certain” to his infrastructure bill. As he continued, though, his tone became more sharp toward Republicans, questioning their support for veterans and other funded priorities in his plan.

Compromises or not, the president has a bumpy road ahead getting his trillions in spending, and the tax hikes to pay for it, through Congress.

“Democrats and Republicans will have ideas about what they like and don’t like about our plan,” Biden said Wednesday. “That’s a good thing.”