Image Credit: capitol.tn.gov

By Dave Vance [Tennessee Firearms Association member] –

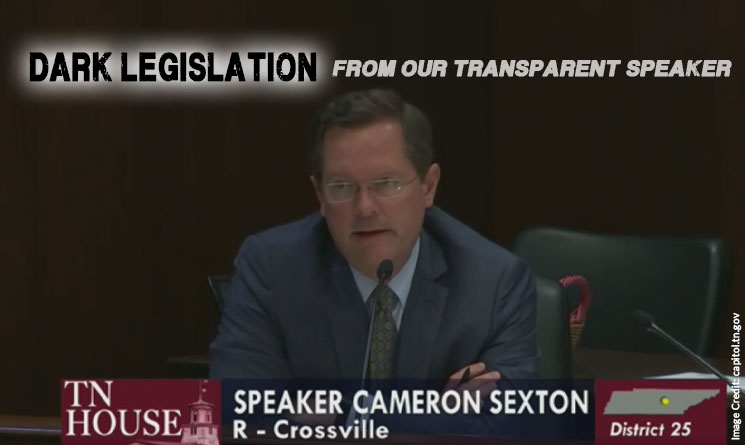

Campaign finance reform legislation proposed by Speaker Cameron Sexton and Senator Randy McNally (HB1201/SB1005 is supposedly all about “transparency”. The proposed legislation deals not only with changes to the reporting requirements for candidates and PAC’s, among other actions but 501C4’s as well in both the House and Senate version.

There are some very significant changes, some good, some bad and there are some slight differences in each version of the bill but it seems a little hypocritical to talk about “transparency “ when both bills started out as 2 page caption bills and were amended to include numerous pages late in the session. Even more hypocritical is that the amendment for HB 1201 that made the bill was passed on a voice vote in committee last week after receiving the amendment late, which is known as an untimely amendment.

This article will focus solely on the issue of 501C4’s and how they will be affected by this legislation (HB1201).

501C4’s are tax exempt non profits and many are issue advocacy organizations. They cannot endorse political candidates or donate to their campaign. They can talk about how candidates have voted for or against an issue. They don’t have to report who their donors are, even to the IRS. In regards to the proposed changes to the law for 501C4’s in Tennessee in HB1201 the “untimely amendment” presented in committee last week states the following in SECTION 30; Tennessee Code Annotated, Section 2-10-132, is amended by designating the existing language as subsection (a) and adding the following as a new subsection (b): (b) Notwithstanding another law to the contrary, an organization that is tax exempt under United States Internal Revenue Service Code § 501(c)(4) (26 U.S.C. § 501(c)(4)) is deemed to be a political campaign committee for purposes of reporting expenditures in accordance with § 2-10-105(c)(1) and (h) and for filing an appointment of treasurer form if: (1) The organization expends an aggregate total of at least five thousand dollars ($5,000) in organizational funds, moneys, or credits for communications that expressly contain the name or visually depict the likeness of a state or local candidate in a primary or general election; and (2) Such expenditures or communications occur within sixty (60) calendar days immediately preceding a primary or general election in which the named or visually depicted candidate appears on the ballot.

It clearly states that 501C4’s will be deemed political campaign committees for purposes of reporting expenditures in accordance with § 2-10-105(c)(1) and (h) and for filing an appointment of treasurer form if they meet the proposed criteria.

*** Click Here to Support Conservative Journalism in Tennessee. We can’t bring you great Editorials like this without your support!***

So what exactly does § 2-10-105(c)(1) and (h) say?

It says the following; 2-10-105. Filing of contribution, loan and expenditure statements — Deadlines — Certification of treasurers and other officers — Retention of records — Additional reporting requirements.

(a) Each candidate for state public office and political campaign committee in a state election shall file with the registry of election finance a statement of all contributions received and all expenditures made by or on behalf of such candidate or such committee. The statement of each candidate for state public office shall include the date of the receipt of each contribution, and the statement of a political campaign committee in a state election shall include the date of each expenditure that is a contribution to a candidate in any election.

(b) Each candidate for local public office and political campaign committee for a local election shall file with each county election commission of the county where the election is held a statement of all contributions received and all expenditures made by or on behalf of such candidate or such committee. The statement of each candidate for local public office shall include the date of the receipt of each contribution, and the statement of a political campaign committee for a local election shall include the date of each expenditure that is a contribution to a candidate in any election.

(c)

(1) The statements required by subsections (a) and (b) of each candidate, each single candidate political campaign committee, single measure political campaign or multicandidate political campaign committee shall be filed quarterly during an election year, within ten (10) days following the conclusion of the quarterly reports ending March 31, June 30, September 30 and January 15. Such candidate and political campaign committees shall also be required to file a pre-primary statement and pre-general election statement. The pre-primary statement shall cover the period from the last day included in the July quarterly statement through the tenth day before the primary election. Such pre-primary statement is due seven (7) days before the primary election. The pre-general election statement shall cover the period from the last day included in the October quarterly statement through the tenth day before the general election. Such pre-general election statement is due seven (7) days before the general election.

(h)

(1) During the period beginning at twelve o’clock (12:00) midnight of the tenth day prior to a primary, general, runoff or special election or a referendum and extending through twelve o’clock (12:00) midnight of such election or referendum day, each candidate or political campaign committee shall, by telegram, facsimile machine, hand delivery or overnight mail delivery, file a report with the registry of election finance or the county election commission, whichever is required by subsections (a) and (b), of:

(A) The full name and address of each person from whom the candidate or committee has received and accepted a contribution, loan or transfer of funds during such period and the date of the receipt of each contribution in excess of the following amounts: a committee participating in the election of a candidate for any state public office, five thousand dollars ($5,000); or, a committee participating in the election of a candidate for any local public office, two thousand five hundred dollars ($2,500). If the committee is participating in the election of candidates for offices with different reporting amounts, the amount shall be the lowest for any candidate in whose election the committee is participating or in which any committee is participating to which it makes or from which it receives a transfer of funds; and

(B) Such report shall include the amount and date of each such contribution or loan reported, and a brief description and valuation of each in-kind contribution. If a loan is reported, the report shall contain the name and address of the lender, of the recipient of the proceeds of the loan, and of any person who makes any type of security agreement binding such person or such person’s property, directly or indirectly, for the repayment of all or any part of the loan.

(2) Each report required by subdivision (h)(1) shall be filed by the end of the next business day following the day on which the contribution to be reported is received.

(3) The registry shall develop appropriate forms for the report required by subdivision (h)(1) and make such forms available to the candidates and the county election commissions.

Notice what it says in (h) (1) (A). Full name and address of each contributor that exceeds the dollar amount listed for state or county races.

So once a 501C4 meets the threshold for being deemed a political campaign committee then all applicable portions of the TCA apply including the proposed reporting changes in this bill. Here are some additional proposed changes to relevant sections of the TCA ;

SECTION 9. Tennessee Code Annotated, Section 2-10-105(h)(1)(A), is amended by deleting the subdivision and substituting instead the following: (A) The full name and address of each person, political campaign committee, or contributor from whom the candidate or committee has received and accepted a contribution, loan, or transfer of funds during such period and the date of the receipt of each contribution that, in the aggregate, equals or exceeds one thousand dollars ($1,000);

SECTION 10. Tennessee Code Annotated, Section 2-10-105(h)(1), is amended by adding the following new subdivision (B) and redesignating the existing subdivision accordingly: (B) The full name and address of each person or recipient entity to whom a total aggregate amount of not less than one thousand dollars ($1,000) was paid during such period, the total amount paid to that person or entity, the date the expenditure was made, and the purpose of the payment. For an independent expenditure, the report must include the name of the candidate or measure supported or opposed;

SECTION 11. Tennessee Code Annotated, Section 2-10-105(h)(2), is amended by deleting the language “contribution to be reported is received” and substituting instead “contribution or expenditure to be reported is received or made”.

SECTION 12. Tennessee Code Annotated, Section 2-10-105(h), is amended by adding the following new subdivisions: (4) (A) Each report filed under subdivision (h)(1) with the registry of election finance must be posted on the website of the registry as soon as practicable. The registry shall develop an electronic filing system for reports required under subdivision (h)(1). – 4 – 017334 (B) Each report filed under subdivision (h)(1) with a county election commission must be posted on the website of the commission as soon as practicable, if the commission otherwise posts campaign finance reports. A county election commission may develop an electronic filing system for reports required under subdivision (h)(1). (5) An expenditure or contribution reported under this subsection (h) must not be omitted or excluded from applicable reports filed pursuant to subsection (c).

So to repeat, if this law passes 501C4’s will be deemed political campaign committees, that are required to list contributions and expenditures as well as the names and addresses of donors. Additionally the $5,000 dollar threshold touted by the Speaker and others is somewhat deceptive based on the actual language in the legislation.

It’s not very common for the Speaker of the house to actually speak in a committee but he did that last week for this legislation. He talked about “dark money” and “transparency”.

So when Speaker Sexton and Rep Williams say in the committee video that this legislation does not treat 501C4’s like PAC’s and or require them to list contributions and the names and addresses of donors they are contradicting what is clearly in the legislation. Speaking of contradictions, if you watch the video they contradict themselves, especially Sexton. Do they not know what is in their own bill? Not likely!

Speaker Sexton Question & Answer 1 – Watch Video HERE.

Speaker Sexton Question & Answer 2 – Watch Video HERE.

Speaker Sexton Question & Answer 3 – Watch Video HERE.

I suspect as do many others this is not really about transparency but about putting additional burdens and risk on small 501C4’s that tell the truth about how all but worthless many of our Republican legislators are in Tennessee. Remember in the video that civil penalties will now be paid by the individual not the organization. And donors’ names will be exposed according to the language of the bill. That might make some hesitate in this era of cancel culture.

Speaker Sexton’s Comments on the bill – Watch Video HERE.

Now, some questions about the Speaker’s comments.

What 501C4’s in Tennessee can he name that are influencing elections with “dark money”.

What elections does he think they have impacted?

What poll or survey has he seen that indicates that this is a big concern with the public?

If transparency is so important to him, why was a multi page “untimely Amendment” ,unavailable to the public, sprung on the committee last week and passed with a voice vote instead of a roll call vote?

If Speaker Sexton is really concerned with transparency then why not pass legislation that requires lawmakers to report all the meals and drinks lobbyists provide for them?

Why not publish the names and photos of all lobbyists that frequent the capitol on the state web site along with the names of the top recipients of their donations?

Why does he allow 501C3 organizations like the Sheriff’s Association to lobby against legislation even though they are not supposed to lobby?

It is a shame that the Speaker feels the need to use his influence to pass this legislation yet apparently didn’t feel stopping the caucus from passing Democrat sponsored legislation that allowed professional licenses to be issued to illegal aliens last week was important.

Why has he not made an appearance or pushed for true constitutional carry to be passed in Tennessee?

Remember too that he will likely run for Governor in 2026.

The Speaker says this is all about transparency and I suspect many of us can see through that claim.

3 Responses

Speaker Sexton (ACU-89%) is showing himself to be surprisingly unfriendly to conservatives which is sort of a waste of the high American Conservative Union score that he has racked up. Someone best tell the Speaker that in 2026 Marvelous Mark Green (Heritage-96%) and Mayor, and soon to be congressman, Andy Ogles will almost certainly be candidates for governor as well. Conservatives will have no shortage of candidates with stalwart conservative records from whom to choose and this legislation with its reporting requirement will be around to remind them who not to choose.

When does Sexton come up for re-election? What a self-serving RINO! His arrogance just makes it worse. Obviously thinks he RULES the legislature! Has to GO!

He’s a state representative Beverly, so every two years lso in a few months to answer your question. Defeating a House Speaker is tough. Let’s just make sure he doesn’t become our governor if he keeps this up.