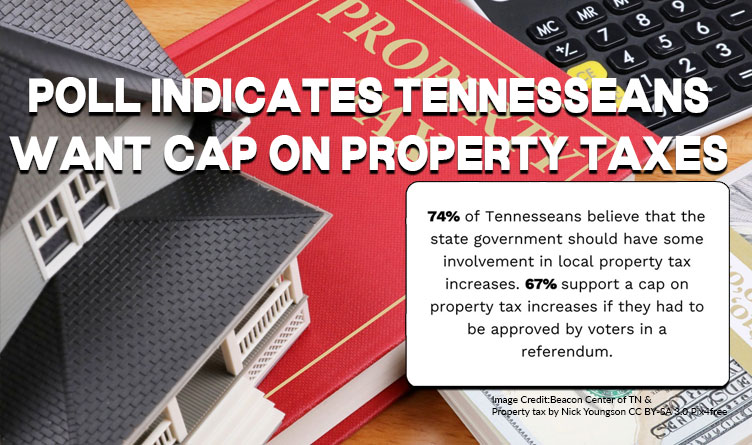

Image Credit: Beacon Center of TN & Property tax by Nick Youngson CC BY-SA 3.0 Pix4free

The Center Square [By Jon Styf] –

A new poll shows Tennessee residents believe the state should be involved in capping how high property taxes can rise.

The Beacon Center poll also showed missed results related to opinions on zoning regulations and affordable housing.

The poll asked more than 1,300 Tennesseans if the state should have a cap on property tax increases and just 11% said local authorities should retain that power while 35% said a statewide cap should exist and 39% said there should be a combination of state regulations and local decision-making.

“It is clear that people are unhappy with the current property tax system in Tennessee, with just 11% of registered voters supporting the status quo of leaving the decision to increase property taxes solely to the local mayor and city council/county commission,” said Beacon Center Vice President of Communication and Outreach Mark Cunningham. “A large majority of Tennesseans (67%) also support a state property tax cap so long as property tax increases have to be approved by voters via referendum.”

The poll also showed 27% believe that local governments are spending property taxes wisely, 31% believe they are not and 42% said they are unsure or neither.

Overall, those polled said that they believe zoning regulations positively impact communities by managing growth and land use effectively while 21% believe they restrict development and personal property use and 20% say they don’t have a significant impact.

Of those polled, 47% agreed that zoning regulations positively control growth while 36% believe that they limit personal use of private property.

A Beacon Center report in mid-2023 following a 2022 listening tour said housing affordability is the most pressing issue in Tennessee and that local and state policies have contributed to an environment where housing prices have outpaced the median income.

The report showed multi-family housing like apartments are banned on 94% of Middle Tennessee land and duplexes are banned on 59% of land.

The poll showed 77% of Tennesseans believe property owners should be able to build an accessory dwelling while 16% were unsure and 8% disagreed.

Accessible dwelling units, such as mother-in-law suites, are allowed on 57.8% of Middle Tennessee land while ADUs can be rented to non-family members on just 34% of land.

“While some people have strong opinions on zoning, it’s clear from the survey that many Tennesseans either aren’t exactly sure what zoning encompasses or don’t know how they feel about it,” Cunningham said. “While our poll shows a plurality of Tennesseans support zoning regulations (40%) as a way to manage growth and only 21% of Tennesseans view zoning regulations in a negative light by restricting development and personal property use, many people (38%) either are not sure how they feel about zoning or don’t think zoning laws have a significant impact either way.”

Zoning regulations impact housing affordability and the poll showed a wide variety of opinions on the best way to make housing affordable.

“Tennesseans are all over the map when it comes to the best approach to affordable housing from the private sector increasing the housing supply without government intervention (16%) to the government directly constructing affordable housing units (7%),” Cunningham said. “While a large portion of Tennesseans are unsure of the best approach to affordable housing, the most popular answers are a combination of public and private sector collaboration.”

About the Author: Jon Styf, The Center Square Staff Reporter – Jon Styf is an award-winning editor and reporter who has worked in Illinois, Texas, Wisconsin, Florida and Michigan in local newsrooms over the past 20 years, working for Shaw Media, Hearst and several other companies. Follow Jon on Twitter @JonStyf.

2 Responses

How about a cap on all taxes?

All property taxes should be eliminate on all private property that is your main residence. Commercial property tax should still be in play, you can write that off as a business expense, but I believe that a cap should be placed on that. As for farmers, small sole proprietor operations should only pay 1% in property taxes on their business since framing is subjected to weather. Corporation farming should pay 12% in property taxes because of the size of their business and the large welfare payments they receive form the government.

More homelessness happens for the poor and the elderly due to taxes. Once you pay your house off then that is it, you shouldn’t have to continue to pay. The government claims they give assistant, but it doesn’t stop the government taking homes to sell for a profit for themselves. Taxes are theft of a persons wealth. Most wealth, 60% of it, is made from owning property. Government has no business in our lives. For those who would say, ” Then how do we pay for schools, police, fire department ect…”

One schools should be paid for by the parents of those children- homeschool, private or tutor your own kids. It doesn’t cost you a lot of money ,just time to educate your kids. Two, 95% of all fire departments are volunteer, equipment is were most of the money goes. Police are hired but both of these departments can and should be funded by donations form the community. We wouldn’t need cops if it wasn’t for the moral decay of our society by ousting God from it- God should have never been removed from our homes, our education, or our town squares. Ten Commandments, follow them and we wouldn’t have the problems of today. As for roads ect…. when you renew your license on your cars you pay for roads though the money collected.

Solutions are easy, put lazy people who fail at life are the ones who complain about lack of services and want government in their lives. Jesus said the poor will always be with us, but he didn’t call upon the government to handle the problem, he called upon the community and the churches to help the poor.

People are willing to give more when they see where their money goes as opposed to have it taken form them.