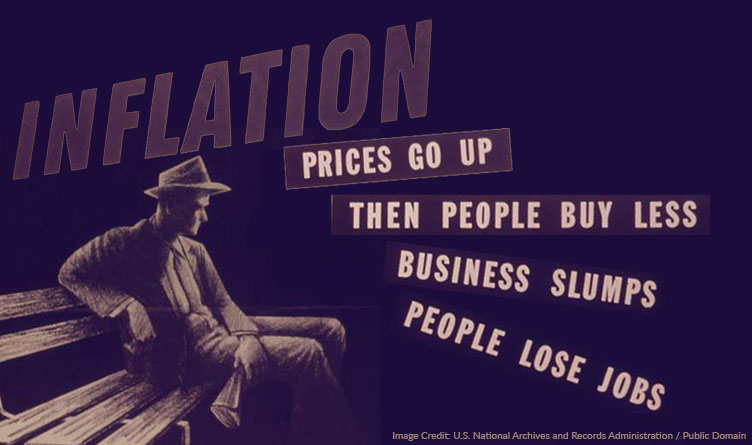

Image: Office of Price Administration flyer from 1941 – 1945 Image Credit: U.S. National Archives and Records Administration / Public Domain

The Tennessee Conservative [By Jason Vaughn] –

The Office of Governor Lee issued a statement that holds out the possibility of additional steps being taken on the state-level to ease the burden of historic rising gas prices and inflation.

The statement came in response to an inquiry by FOX13 as to whether the Lee Administration may entertain a 90-day state gas and diesel tax moratorium as proposed by Nashville Democrat Representatives John Ray Clemmons and Bo Mitchell in March of this year.

Lee’s statement said, “As the national cost-of-living continues to climb due to historic inflation, Governor Lee has enacted two separate tax cuts for Tennesseans: a 30-day suspension of local and state grocery tax + a suspension of the annual vehicle registration fee. These two initiatives are a starting point, and in the coming months, we will continue reviewing options to ease the burden on Tennesseans amid historic national inflation.”

Memphis Democrat Representatives Antonio Parkinson and Raumesh Akbari have renewed the push for the state-level gas tax moratorium.

Parkinson said, “It’s tough out there. People are having to make the decision between gas and other bills.”

Akbari acknowledged that eliminating the gas tax “is difficult because that’s how our road projects are funded” but noted that the State is receiving a considerable amount of infrastructure funds from the federal government.

She also pointed to the fact the State is consistently running a surplus in its budget.

In Tennessee, gas tax is 27.4 cents per gallon.

Other states, such as Mississippi, are in discussions about a gas tax moratorium and Connecticut has already implemented one.

*** Click Here to Support Conservative Journalism in Tennessee. We can’t cover stories like this without your support!***

Meanwhile, District 5 Republican primary candidate for U.S. Congress, Maury County Mayor Andy Ogles, has taken it to the National level with a call for the Democrat controlled House and Senate to immediately pass a 90-day moratorium on federal gasoline and diesel taxes.

In a statement obtained by The Tennessee Star, Ogles said in part, “As Democrats refuse to consider returning to the pre-Biden energy policies that had gas prices in the $2.20 range, the least they can do is give families a break this summer as we struggle with the Biden-flation caused by his inept and misguided energy and economic policies.”

“Earlier this year, Democrats in the Tennessee Legislature sought a moratorium on the state gas and diesel taxes, but they failed to address the federal fuel taxes that Democrats in Washington could immediately freeze,” Ogles pointed out.

The statement goes on to say that Ogles, as state director of Americans for Prosperity, “led the fight against the 2017 gas and diesel tax increase here in Tennessee, which raised gas taxes 6 cents per gallon and diesel by 10 cents. He brought hundreds of grassroots activists to the state legislature to meet with their representatives (and) spearheaded a state-wide awareness campaign…”

Ogles stated that eliminating the state gas tax increase for 90 days would be a small measure, but still helpful for Tennessee drivers.

However, if both the state and federal tax were eliminated for that time, gas would cost 24.4 cents less per gallon.

Ogles said that “would put about $225 MILLION into the pockets of Tennesseans this summer.”

Ogles also stated that he hopes the Tennessee legislature and Governor will take any actions necessary to give Tennesseans some relief, and call a Special Session of the General Assembly if needed.

One Tennessee Republican Representative, Bruce Griffey (R-Paris-District 75) attempted to give Tennesseans some relief at the pump in the last legislative session with House Bill 1650 that aimed to repeal Tennessee’s IMPROVE Act.

The IMPROVE Act (Improving Manufacturing, Public Roads, and Opportunities for a Vibrant Economy) created a step-up system to raise gasoline tax by a few cents per year. Gasoline is defined as gasoline, ethanol, methanol, E-85, M-85 and A-55.

Representative Griffey said in regards to his bill back in December, “Under my legislative proposal, the State would continue funding transportation and highway projects at the same financial level while at the same time giving tax relief to its citizens. We wouldn’t miss a beat with our infrastructure projects because Tennessee has the money. In fact, our coffers are overflowing and we are on a continued revenue growth trajectory, which is why the legislature needs to be looking at reasonable ways to effect responsible tax reform and mechanisms to return excess tax collections to taxpayers. My bill is one way to do it.”

“I was opposed to the gas tax increase when it passed, and vowed to take action to fight it if elected to office. With gas prices exponentially rising due to inflationary pressures from bad, reckless policies of the Biden Administration, it is imperative now more than ever to provide financial relief to Tennesseans at the pump,” Griffey said.

The bill was assigned to the House Transportation Subcommittee on January 13th, 2022 but didn’t move forward or receive a Senate sponsor.

Griffey’s bill will likely not be picked up in future legislative sessions since he made the decision to leave the legislature after the last session to seek a position as a Tennessee Circuit Court Judge.

About the Author: Jason Vaughn, Media Coordinator for The Tennessee Conservative ~ Jason previously worked for a legacy publishing company based in Crossville, TN in a variety of roles through his career. Most recently, he served as Deputy Director for their flagship publication. Prior, he was a freelance journalist writing articles that appeared in the Herald Citizen, the Crossville Chronicle and The Oracle among others. He graduated from Tennessee Technological University with a Bachelor’s in English-Journalism, with minors in Broadcast Journalism and History. Contact Jason at news@TennesseeConservativeNews.com

3 Responses

Be very careful about eliminating taxes to reduce the cost of something. Increasing prices will lower demand for a good. Lowering or eliminating taxes will increase demand, causing prices to rise. The problem won’t be solved by simply removing the tax, though there might be longer lines at the gas pump as motorists try to take advantage of the lower prices. It might even entice driving across state lines to take advantage of the tax-free gas, putting additional upward price pressure on fuel. Eliminating the fuel tax is no panacea.

TAXES are all to high it is gotten to the point we cant afford to live in our own country. WE pay out billions for ILLEGALS, that don’t even belong here. WE have had two million people come across out border, with more coming every day. WE have drugs and crime on the rise, and we are paying big dollars for that also. IF they want to help people, maybe they should START WITH WHAT IS CAUSING THE PROBLEMS.

Ok, so 30 days of a few cents “relief” on astronomically high fuel prices.

What, if anything, are the Tennessee elected officials doing to push the White House for energy independence in America?

That is the ONLY way to help the economy and all Tennesseans!