Is Chapter 11 Bankruptcy A Final Act Or A Fresh Page For The NRA?

Photo Credit: Shutterstock

Published January 29, 2021

The Center for Responsive Politics [By Anna Massoglia and Alyce McFadden]-

The nation’s most powerful gun rights group filed for Chapter 11 bankruptcy on Jan. 15, seeking to restructure in Texas and avoid legal action in New York.

New York’s attorney general began investigating the National Rifle Association on corruption charges in 2019 and moved to dissolve its 501(c)(4) nonprofit in 2020.

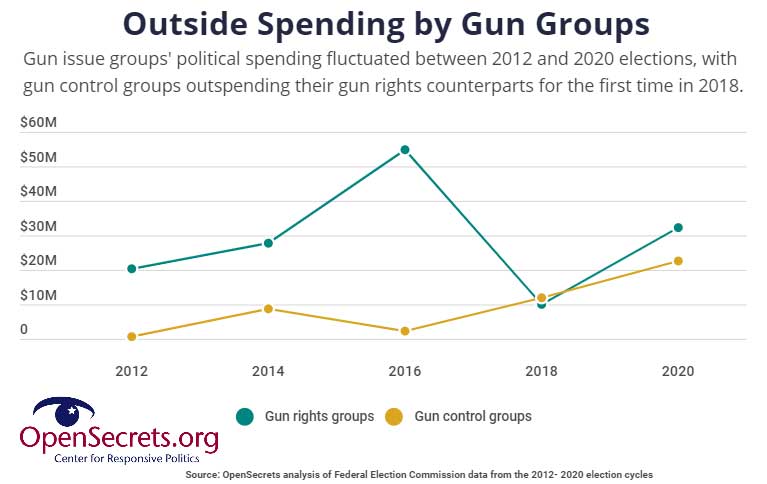

Plagued by financial challenges and mounting legal issues, the NRA’s political spending has declined significantly in recent years. The group was once among the most influential outside forces in electoral spending.

The NRA spent $29.1 million in 2020 federal elections, most of that to support former President Donald Trump in the final months of the cycle, with around $19.5 million of that spending bankrolled by its newly created NRA Victory Fund super PAC and $9 million by its traditional PAC.

Just four years earlier, the group spent $54.4 million during the 2016 election cycle, breaking the group’s prior spending records. Of that, $31.2 million went toward Trump’s first presidential campaign alone. Most of the NRA’s 2016 spending was routed through its main 501(c)(4) “dark money” group, which does not disclose its donors.

As the NRA struggles, spending by gun control groups is on the rise.

Since 2012, the NRA’s political opponents have gained momentum. Donations to gun control focused nonprofits and PACs including Everytown for Gun Safety and Giffords PAC have increased consistently.

During the 2018 midterm elections, gun control groups outspent the NRA for the first time by a $2.6 million margin. In 2020, these liberal-aligned groups spent $23.5 million, falling short of the NRA’s spending.

The NRA significantly outspends gun control groups on lobbying efforts.

Since 2012 — when mass shootings at Sandy Hook elementary school and a movie theatre in Aurora, Colo., left a combined 40 people dead and spurred a nationwide gun control movement — the NRA spent an average of $3.6 million each year to oppose bills such as the Protect America’s Schools Act and the Keep Americans Safe Act, which would have limited access to devices that allow guns to rapidly discharge many rounds of ammunition.

But the gun rights group has tightened its purse strings on lobbying spending since 2017, when it spent $5.1 million on lobbying efforts and employed 26 lobbyists. In 2020, the group spent $2.2 million on lobbying and employed just 18 lobbyists.

However, gun-rights lobbying continues to dwarf gun control lobbying. The latter sector spent just $2.1 million in 2020, while gun rights groups, including the NRA, the National Shooting Sports Foundation and Gun Owners of America, spent a collective $10.2 million.

Chapter 11: A final act or a fresh page for the NRA?

In its bankruptcy filings, the NRA reported between $100 million and $500 million in assets and the same amount in liabilities.

In 2018, OpenSecrets reported that the political nonprofit’s financial disclosures showed a deficit of $14.8 million in the wake of its 2016 spending frenzy. The NRA reported spending around $12.2 million more than it brought in over the course of 2019, the most recent year with financial information available.

The NRA’s bankruptcy records include a debt of $1.3 million to advertising agency Ackerman McQueen, its largest creditor listed, but note that the amount owed is disputed since the NRA sued the agency in 2019 after a disagreement over billing. That lawsuit is still pending.

The gun rights group’s tax returns detail more than $7.3 million in 2019 payments to the agency, which crafted many of the NRA’s most memorable ad campaigns over the last three decades, for “public relations and advertising.”

Bankruptcy records also show around $960,000 owed to Membership Marketing Partners LLC, which shares an address with the NRA. The NRA reported paying the limited-liability company nearly $11.6 million for “fundraising printing and mailing” in 2019 alone, according to its most recent tax returns.

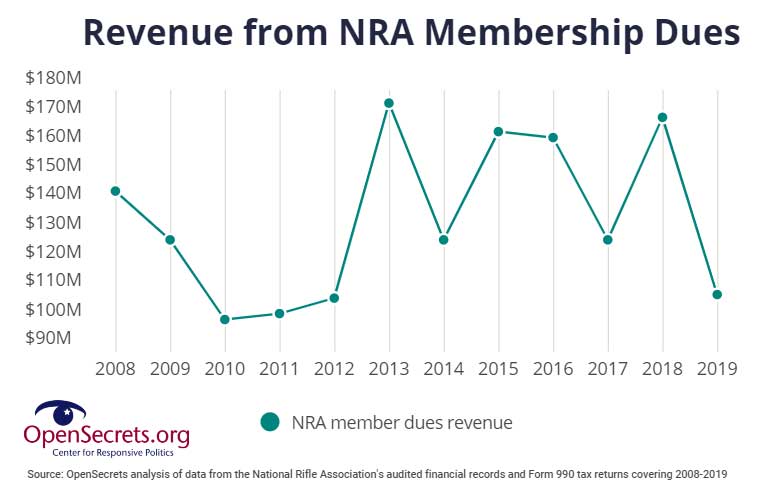

Adding to its fiscal predicament, the NRA’s membership has fallen since 2016, when it raised $163 million from membership dues. By 2019, that sum was down to $113 million. As membership dues dropped, the NRA sought funding from other sources. The group received more than $300 million from the NRA Foundation since 2008 in the form of grants and reimbursements, topping $27.4 million in 2019 alone, according to OpenSecrets analysis of the NRA’s financial audits and tax records.

That year, the NRA’s 501(c)(4) nonprofit covered $2.9 million in expenses for the NRA’s political committee, according to its most recent financial audit. Though the political nonprofit arm does not disclose its donors, the NRA’s website lists major firearms manufacturers as “industry allies,” some of which have publicly announced contributions to the NRA.

The NRA continued spending on foreign fundraising into at least 2019, according to its most recent tax records, the second year it has disclosed such spending. The gun rights group disclosed foreign fundraising spending for the first time in its history the prior year as it faced a multimillion-dollar shortfall for a third consecutive year.

The coronavirus pandemic exacerbated the nonprofit’s troubles, prompting the group to cancel fundraising events, lay off dozens of employees and cut remaining staff members’ pay by 20 percent. Despite all this, the NRA’s bankruptcy announcement boasts that it is “in its strongest financial condition in years.”

The nonprofit is headquartered in Virginia but legally domiciled in New York.

It hopes to avoid James’ effort to dissolve the group by restructuring in Texas, a state it claims is the appropriate venue for its bankruptcy proceedings because it formed a limited-liability company, Sea Girt LLC, with a Dallas address in November 2020 — less than two months before the bankruptcy filing at a Dallas federal court. The LLC, which is listed as an “affiliate” of the NRA, made a separate bankruptcy filing on the same date at the NRA, listing less than $100,000 in liabilities.

The NRA has not announced any plans to relocate its business headquarters to the Lone Star State, and has been up front that its goal of the filing for bankruptcy in Texas is “resolving the claims of the NYAG.”

However, the move does not necessarily mean that the NRA will be able to avoid the New York lawsuit, since government enforcement actions are generally not subject to the provision normally imposed in Chapter 11 filings that prevents creditors from pursuing debts owed by the party filing for bankruptcy.

In a Jan. 15 statement, James reaffirmed her commitment to seeing her investigation through. “The N.R.A.’s claimed financial status has finally met its moral status: bankrupt,” James said. “While we review this filing, we will not allow the [NRA] to use this or any other tactic to evade accountability and my office’s oversight.”